You might think that budget management is a fairly straightforward task. You set a budget, monitor your spending, and adjust if necessary. It won’t be that difficult, right? Wrong.

Even the most diligent businesses find it challenging to manage their budgets effectively. And it gets even harder when you have multiple departments and locations across different regions. It’s not just about knowing how much you have left in your budget somewhere; it’s about making sure all of your financial activities are aligned with your strategy so that every dollar counts. As an organization leader, you know that effective budget management is essential for success. It can also be quite challenging to implement a sound budget management system in your organization because of the large number of moving parts within any organization.

Furthermore, there are many factors to consider when choosing the right tools for managing budgets so that you don’t have to worry about them again in the future. How can you help your organization thrive by putting its finances on track? In this article, we would take a look at some budget management problems and possible solutions.

3 Common Budget Management Problems:

As financial experts will tell you, budget problems are not always necessarily caused by shortages in funds. Sometimes it’s a lack of understanding on how to manage those funds, or simply a lack of discipline that leads us to these problems. Let us take a look at these 3 common budget problems:

- Consolidation of spreadsheets manually.

- Manually tracking expenses.

- Conflicting budget versions.

Also read: PROCUREMENT VS. PURCHASING: WHAT IS THE DIFFERENCE?

Consolidation Of Spreadsheets Manually:

It could take many weeks and several unnecessary manual works to consolidate several departmental plans into a single master plan. The bigger the organization, the more hassle it is. Continually relying on spreadsheets causes inefficient manual processes, greater error risks, high operational costs, etc.

Manually Tracking Expenses:

Another problem is the poor tracking of expenses. Because these things are done manually, it does not matter if the finance team is able to set a good budget if the tracking of the expenses is not as good, it becomes a problem because enforcing the budget is as good as developing it.

Conflicting Budget Versions:

Confusion results if there are too many budget versions. A wrong version of the budget can be used, or one done for a completely different purpose. Operational budgets at organizations usually consist of projected income statements among other supporting statements, having these statements in different versions can be chaotic.

In this section, we will analyze some of the common budget management solutions.

Possible Budget Management Solutions:

Budgeting:

Companies often take the first step to solving their budgeting problems by implementing an effective budget planning process. This process allows any organization to take control of its finances to meet its goals and objectives. Taking everything into account, the purpose of budgeting is to plan different business operations phases, coordinate activities of different departments of the organization, and ensure effective control over it.

Forecasting:

Organizational forecasting is a method that can help businesses anticipate future market changes allowing them to plan with accuracy for budgetary needs. The budget forecast is used to predict the outcome of the budget if followed as expected. Creating this budget forecast is straightforward once the budget is in place.

Outsourcing:

Companies may use outside consultancies or outsourcing firms for certain tasks, in this case incorporating a forecast into the outsourced service can help forecast budgets more accurately. When an organization uses outsourcing, it gets the assistance of outside organizations not affiliated with the company to complete certain tasks. This enables the organization to lower its labor costs.

Modern Technology:

The most effective budget management solution is introducing modern technology like Yaraa for more efficient results and planning. Yaraa is a software that can be used for efficient procurement. It is a cloud-based software that can be used by businesses of all sizes.

Yaraa’s Budget Management Key Features:

Yaraa’s budget management tool helps you track expenses, create reports, and stay on track with your spending. It is optimized to provide proactive spending, monitoring and budget management services. Let us have a look at some key features:

- Setup budget per location and project.

- Receive regular updates on budget balance to keep you aware.

- Receive personalized prompts when you exceed a spend limit.

Setup Budget Per Location and Project:

Yaraa’s budget management tool is optimized to setup budget per location and project. That is, it tailors your organizations budget to suit any location and personalizes projects.

Receive Regular Updates on Budget Balance to Keep You Aware:

Yaraa’s tool makes budgeting seamless. Your organization receives updates regularly on budget balance to keep you aware on what is going on with your spendings.

Receive Personalized Prompts When You Exceed a Spend Limit:

You do not have to manually check for spends and whatnot, because Yaraa makes budgeting stress free. Yaraa sends personalized prompts when a spend limit is exceeded.

Asides the budget management key features, Yaraa also offers:

- A 2-day free trial with full access to all its features,

- Three packages – starter, standard, and enterprise.

How To Setup Your Budget Management Profile On Yaraa

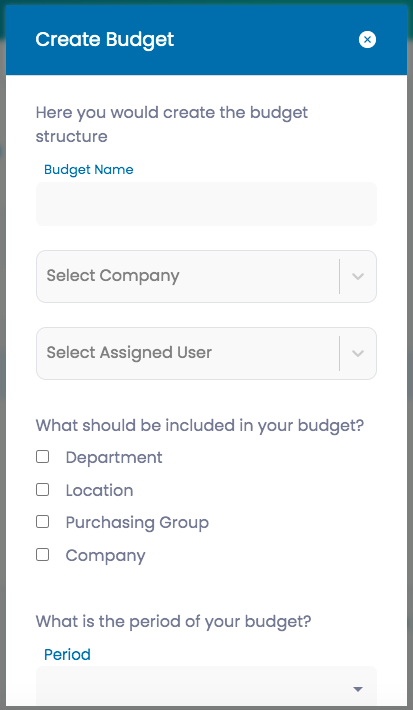

To set up your organization’s profile on Yaraa’s e-procurement platform, you need to create your budget’s structure as shown in the image below:

Budget Name:

The budget name is dynamic, you can give it any name that resonates with the project being worked on. This feature is made in a way that you can set up different budgets for different projects without having mix ups. This is the first requirement when setting up your budget management profile on Yaraa.

Select Company:

When you are done setting up your budget name, the next step is to select your company. You can register different companies on Yaraa’s platform and also register your subsidiaries on the e-procurement platform. This way, you can manage different budgets for any of your companies with zero hassle.

Assign User:

Once you have set up the company’s budget you intend to manage, your next step is assigning a user responsible for managing the budget. Yaraa’s platform gives you the opportunity to assign users to handle the budgeting at a high level or based on the parameters included in the budget..

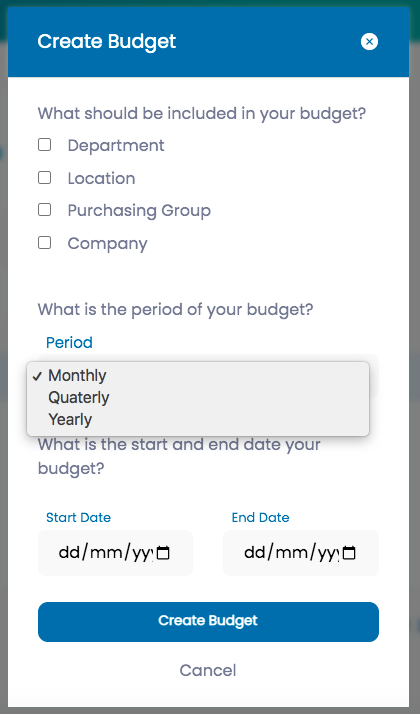

What Should Be Included In Your Budget?

After setting up users for your organization’s profile on the platform, the next step is filling out important details for your budget. This section lets you state what department, location, purchasing group, and legal entity can be selected. This determines at what level the budget needs to be managed.

What Is The Period Of Your Budget?

After setting up the above, the next step is setting up the duration of your budget. You have the option of choosing monthly, quarterly or yearly. Once this has been set up, you have to include your start and end date for the budget.

Create Budget:

This is the final stage in setting up your budget management on Yaraa’s platform. Check every information filled in your profile to make sure they are accurate for each project, then create the budget.

The software arranges everything appropriately for the different budgets after you have selected these parameters.

Yaraa’s budget management platform is a versatile tool that can be customized to fit the specific needs of your organization. Schedule a demo to learn more about how Yaraa can help you save money and improve your organization’s budget management.